You can only buy Medigap if you have Original Medicare. That means you have to sign up for both Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) before you can buy a Medigap policy.

What is Medicare Supplemental Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private insurance company to help pay your share of costs in Original Medicare.

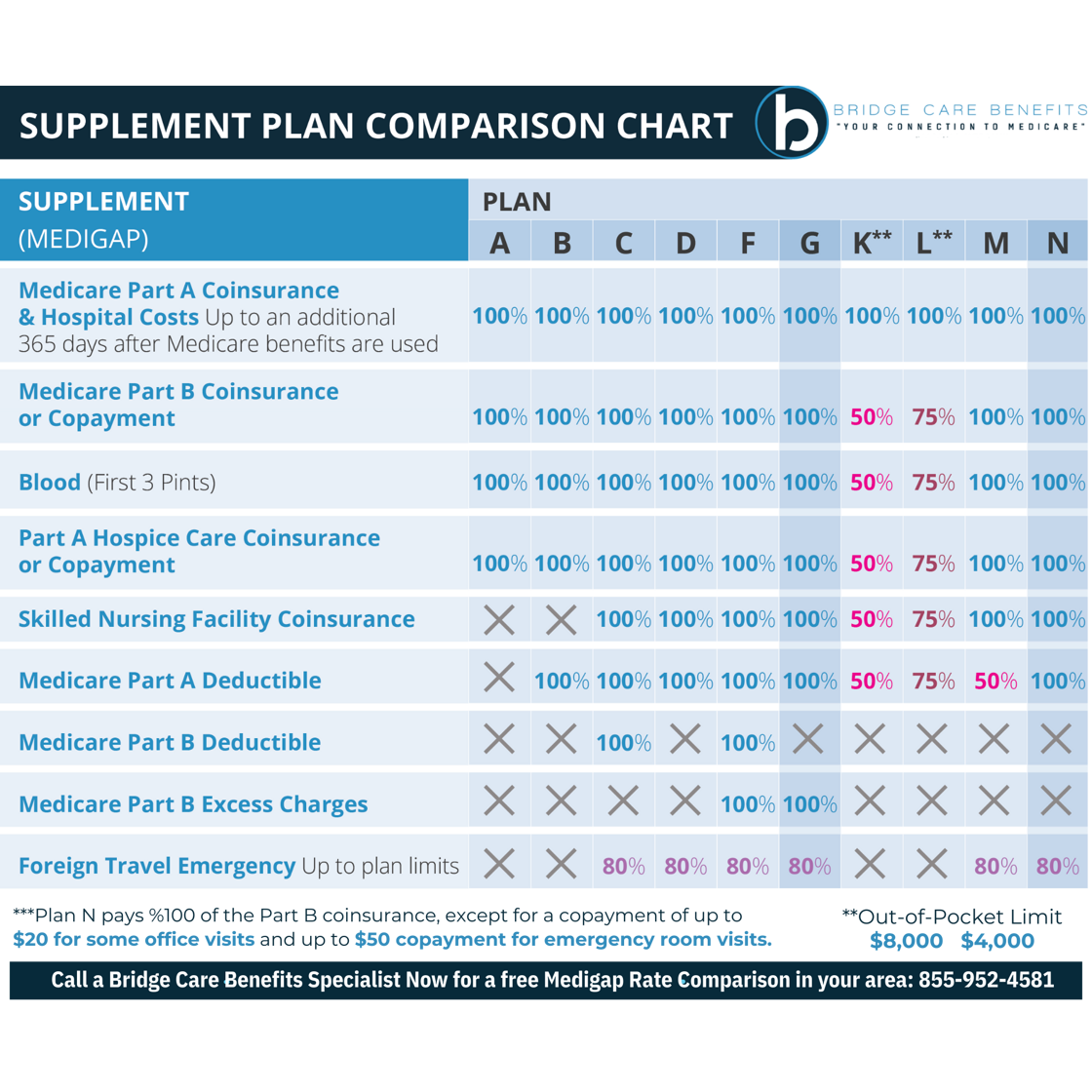

All Medigap policies are standardized. This means, they offer the same basic benefits no matter where you live or which insurance company you buy the policy from. There are 10 different types of Medigap plans offered in most states, which are named by letters: A-D, F, G, and K-N. Price is the only difference between plans with the same letter that are sold by different insurance companies.

Every Supplemental policy must follow federal and state laws designed to protect you. It’s important to watch out for illegal practices by insurance companies, and protect yourself when you’re shopping for a Supplemental policy.

Contact us for an appointment to go over Supplemental Plan Options in detail.